40+ do mortgage lenders use your fico score

Because this level of score is above average it indicates to lenders that the consumer is low risk and likely to. No Impact On Credit Score.

What Credit Score Do Mortgage Lenders Use Lexington Law

Web Credit scores are based on your credit history which are calculated from the following factors.

. Web FICO scores are used in 90 of mortgage application decisions in the United States. Ad Try Our Free Eligibility Checker Now. Loan Secured On Property.

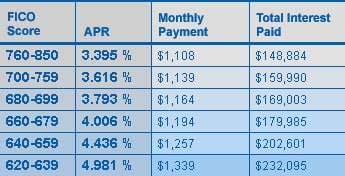

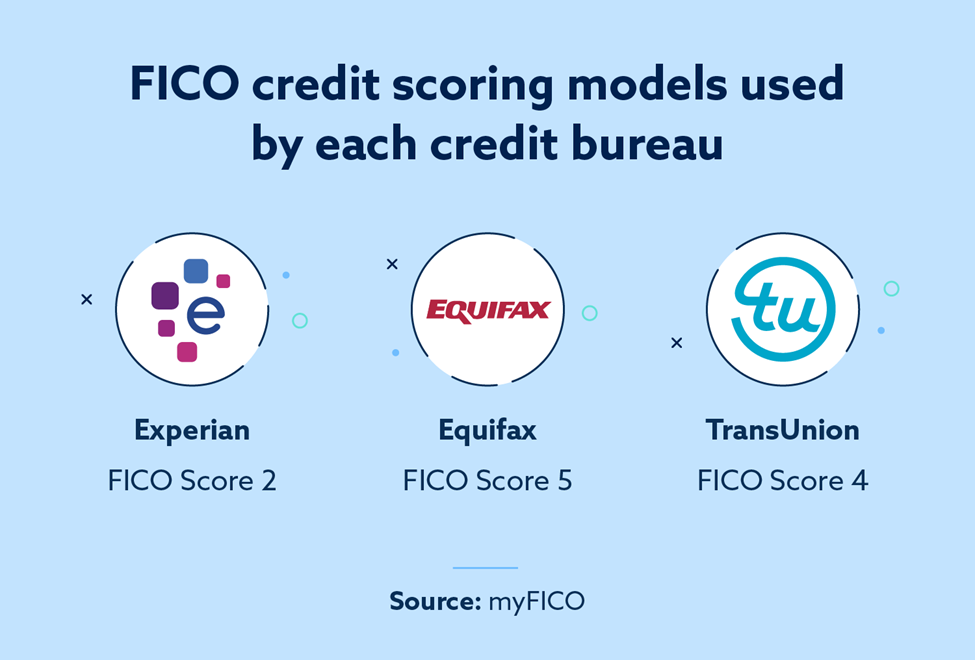

In general scores in the range of 670 to 739 indicate a good credit history and most lenders will consider this. Web The most commonly used FICO Score in the mortgage-lending industry is the FICO Score 5. Web Mortgage lenders typically use FICO Scores 5 2 and 4 when determining whether or not to approve a loan.

You can get free copies of your credit reports directly from each of the major consumer credit bureaus Equifax Experian and. Web Which FICO Scores Do Mortgage Lenders Use. Ad Try Our Free Eligibility Checker Now.

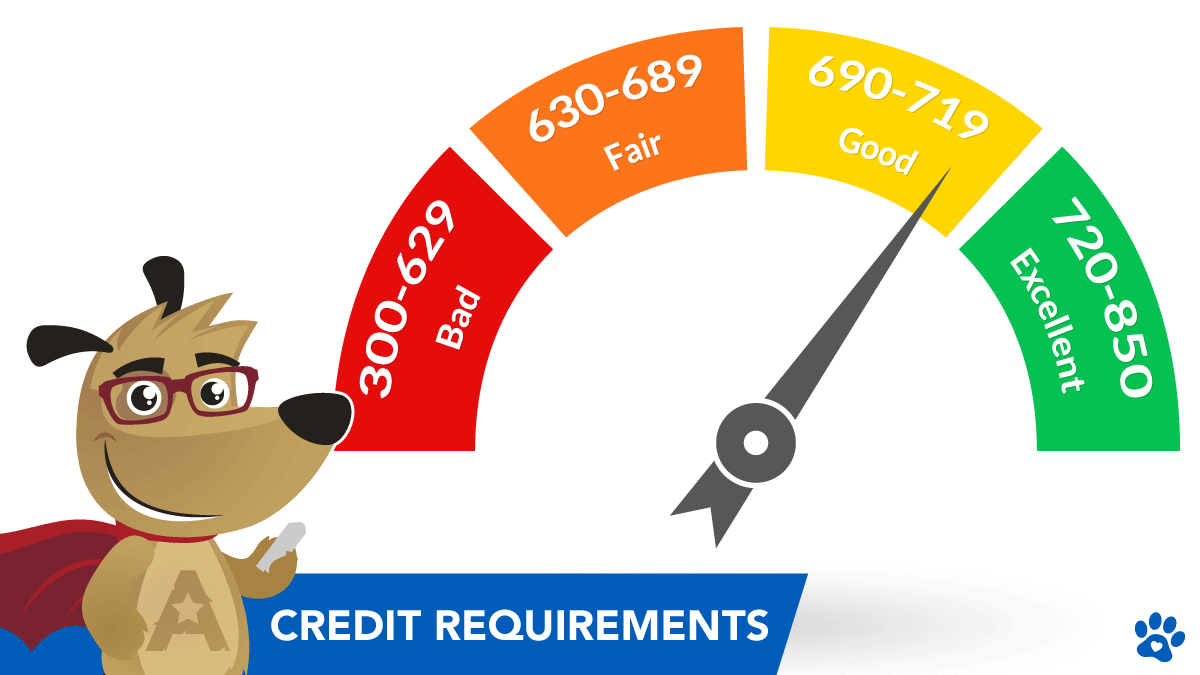

Loan Secured On Property. What Credit Score Do Lenders Use. This score can range from 300 to 850.

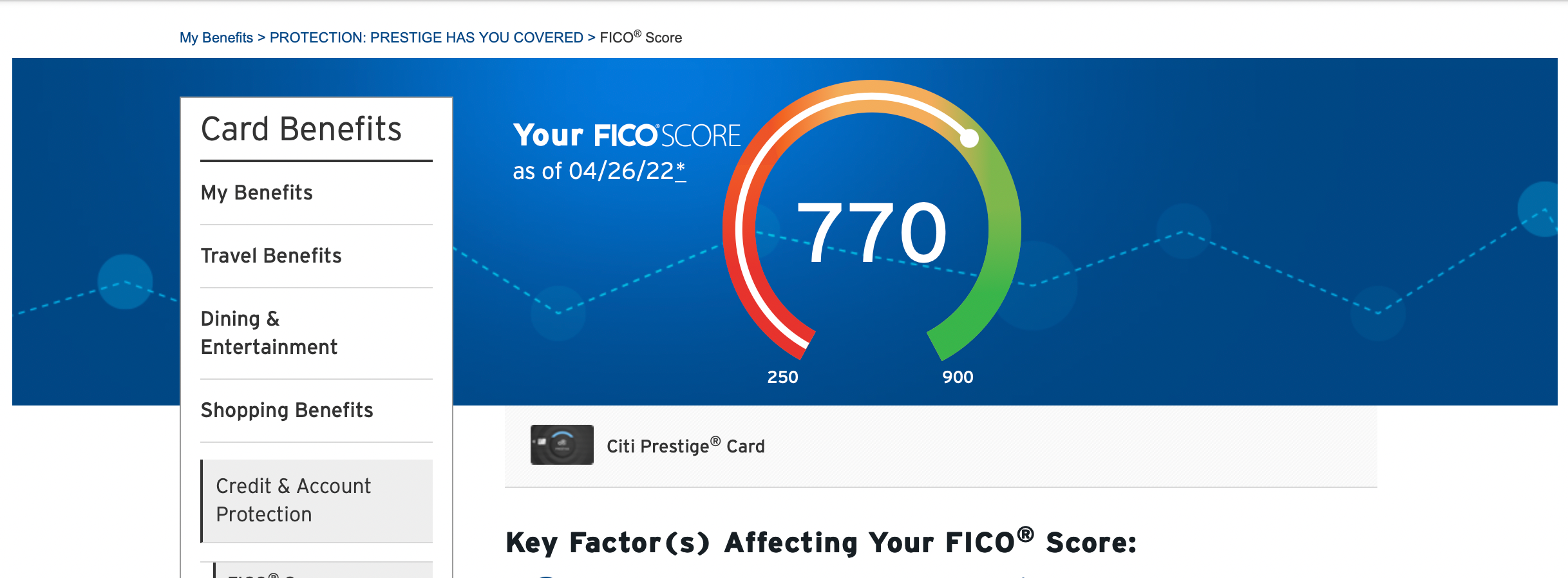

Web A Very Good FICO Score is in the range of 740 to 799. The FICO score is a measurement of the borrowers credit history. Web Your lender or insurer may use a different FICO Score than the versions you receive from myFICO or another type of credit score altogether.

ExperianFair Isaac Risk Model v2. Web The overall FICO score range is between 300 and 850. Web The versions of the FICO Score that are used on mortgage loans and the more recently released versions such as the FICO Score 9 and 10 have the same.

The two main companies that produce and maintain credit scoring models are FICO and. No Impact On Credit Score. FICO credit scores are used by most lenders to evaluate a borrowers creditwortThe FICO scoring methodology has been updated over the years and lenders can chIndustry-specific FICO scores are also available for different types of cr See more.

In general scores in the range of 670 to 739 indicate a good credit history and most lenders will consider this. FICO generates scores between 300 and 850. Web There are five different FICO score models currently used by most lenders of all types.

If youve applied for a credit card mortgage or car loan you probably know that you. Web All the latest generic scoring models range from 300 to 850 with a higher credit score being better. Check If You Will Be Accepted - Before You Apply.

However FICOs industry-specific models and VantageScore. Fix your mortgage rates for 5 yrs. FICO Score 2 4.

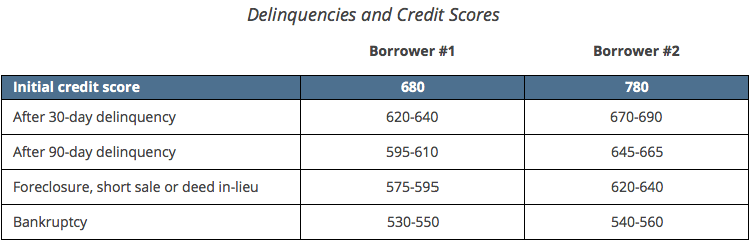

Web Here are the specific versions of the FICO formula used by mortgage lenders. Payment history 35 Total amount owed 30 Length of credit. Any score that falls below 580 is considered poor.

Web Most mortgage lenders use the FICO Credit Scores 2 4 or 5 when assessing applicants. Another option is to go to a. Web What credit score do lenders rely on.

Web National averages of the lowest rates offered by more than 200 of the countrys top lenders with a loan-to-value ratio LTV of 80 an applicant with a FICO credit. Web New consumer credit files opened. The vast majority of mortgage lenders use the same ones.

Scores range from 300 to 850 with scores in the 670 to 739 range. Additionally one type of credit score to keep an eye. Check If You Will Be Accepted - Before You Apply.

Web The overall FICO score range is between 300 and 850. Mortgage lenders who offer conventional mortgages are required to use a FICO Score. Web The FICO score range helps mortgage lenders determine what type of borrower you are based on the financial picture provided by your personal score.

Web How to get a free credit report. According to FICO the majority of lenders pull credit histories from all three credit.

National Mortgage Professional Magazine January 2018 By Ambizmedia Issuu

What Credit Score Is Needed To Buy A Home

Understanding Credit Score Differences The Points Guy The Points Guy

Why Can T People Understand That Having Alot Of Money Won T Bring Happiness Having Alot Of Money Is A Curse The Government And Criminals Will Both Be After Your Money One For Taxes

Can You Get A Mortgage In Texas Without A Credit Score

How And Why To Check Your Credit Score If You Plan On Buying A House

What Credit Score Do Mortgage Lenders Use Info On Fico Score Options

What Credit Score Is Needed To Buy A Home

What Credit Score Do Mortgage Lenders Use Lexington Law

Credit Requirements For A Reverse Mortgage In 2023

Daily Corona Virus Mortgage Updates Mortgage Broker Vancouver Bc Burnaby Bc Canada

:max_bytes(150000):strip_icc()/GettyImages-1251467407_1_journey_crop-fico-e2c753e8274442bb9836be06bfaf43fe.jpg)

Which Fico Scores Do Lenders Use

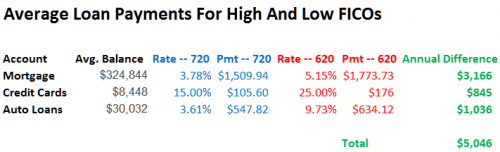

Raise Your Fico 100 Points In 2023 And Save Big On Everything

Which Fico Score Do Mortgage Lenders Use Credit Strong

The Average Credit Score To Qualify For A Mortgage Is Now Very High

How Do Charge Cards Affect Your Credit Score Forbes Advisor

Down The Up Escalator How The 99 Percent Live In The Great Recession Garson Barbara Amazon De Books